For many years, there has actually been a growing pattern of fintech facilities gamers worldwide In Africa, a handful of start-ups have actually introduced in the previous 3 years to offer such services. Stitch, a South African fintech start-up, is among them and today, it is coming out of stealth and revealing its seed round of $4 million. This makes it the biggest round raised by any API fintech start-up in Africa at the minute.

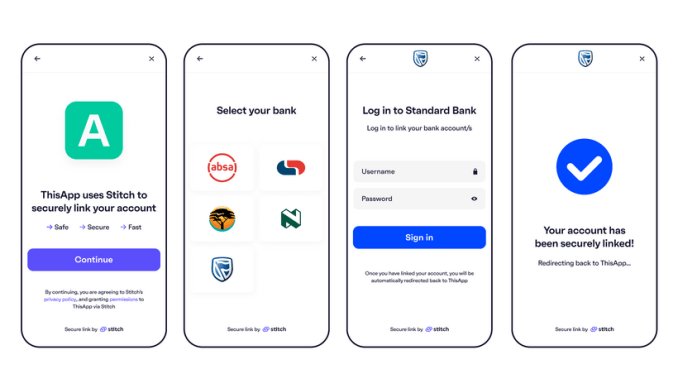

Established by Kiaan Pillay, Natalie Cuthbert, and Priyen Pillay, Sew wishes to offer complete API access to monetary accounts throughout Africa beginning with its very first market, South Africa With its API, designers can link apps to monetary accounts. This enables users to share their deal history and balances, verify their identities, and initiate payments

We have actually seen a wave of API-led monetary services business multiplying around the world. Plaid blazes a trail in the U.S. Sweden-based fintech Tink has actually likewise been dominant throughout Europe, while Truelayer and Belvo are holding the specialty in the UK and Latin America

These business offer engineering and designer tools that decrease the technical and functional effort required for apps to link to their users’ monetary accounts By method of APIs, they make it possible for other business to incorporate what are otherwise complicated services to develop from the ground up merely by including a couple of lines of code.

Like other monetary facilities business, Sew services enables business and designers to innovate around other services like individual financing, financing, insurance coverage, payments and wealth management

The creators make use of previous experience structure API items for regional markets in the past In 2017, Kiaan Pillay worked as the head of operations for South African insurance coverage API platform Root He left a year to Smile Identity, a San Fransisco-based identity API business. There, he dealt with fintechs throughout Africa and found they dealt with infrastructural concerns around compliance and identity

The Stitch group

At the exact same time, Pillay, Cuthbert– who was the CTO at Root– and Priyen were aiming to develop a Venmo for Africa, however after 8 months, they quickly found the service was bad Nevertheless, one function on the platform appeared to work for the fintechs with infrastructural concerns

” We specified where we might develop any payments for our customers so users might connect and squander their checking account,” Pillay informs TechCrunch “We chose to automate this procedure utilizing screen scraping. I should confess, it didn’t look great however we took it in our stride due to the fact that we believed it served its function and was incredibly cool.”

This set the collaborate to deal with Stitch– Pillay as CEO, Cuthbert as CTO and Priyen as CPO. After dealing with structure much better performance and innovation, Stitch beta introduced in September 2019 and protected a pre-seed round a month later on While in stealth, Stitch states it has actually gotten a handful of customers, that include Intelligent Financial obligation Management, Momentum Speed Club, Paystack, Flexclub, and 2 of South Africa’s greatest insurance coverage gamers The business is likewise starting to bring in some attention from business business around consumer-facing items

Currently, Stitch has an information and identity API item, and this month, a payment item will be included to its offerings Like the majority of API fintech start-ups, Sew charges designers and business per API call. Nevertheless, for some items like budgeting or individual financing management apps, it likewise charges a set charge

With large and deep financier support, Stitch will utilize the financing to combine development in South Africa There are strategies to likewise introduce operations in West and East Africa; the business’s declaration checks out

Africa’s monetary facilities area is warming up

These markets currently have gamers, generally Nigerian start-ups, in the API fintech area. They have actually raised significant rounds with excellent supports also. Mono, a start-up that just introduced 6 months earlier, is backed by YC; For Okra, it is Pan-African VC company TLcom Capital; OnePipe has Techstars, and US-based however Africa-focused Pngme has actually brought in financial investment from Pan African VC companies EchoVC and Lateral Capital

In the meantime, these start-ups do not run in more than 2 nations. For example, Mono, Okra and OnePipe are just reside in Nigeria. Pngme states it’s running in Nigeria and Kenya, while Stitch is just in South Africa. It will be fascinating to see how competitors and cooperation play out when they broaden outside their markets We may not wait long as Okra is presently in beta in Kenya and South Africa, and Mono is preparing a growth into Ghana and Kenya prior to completion of the year

This does not trouble Pillay and his group at Stitch, however. He, together with creators of these start-ups who I have actually talked with in the previous year, think competitors is healthy for the marketplace, and more creators must in fact develop comparable business That stated, Pillay includes that what may play out is each business developing a specific niche performance at which they’re finest

” Unlike the U.S. where Plaid is dominant, I believe the African market requires numerous gamers due to the fact that the marketplace is big. Europe is a fine example; numerous significant business are offering comparable banking API services For us, I believe what we would begin to see occur is that some business will be understood to do a specific performance well like payments, information enrichment, or merchant recognition“

Image Credits: Stitch

Stitch has an excellent lineup of financiers for this seed round led by London-based VC company, firstminute Capital and SA-based financial investment company,The Raba Partnership Other financiers who participated consist of both funds and angels.

The funds consist of CRE and Town Global, Norrsken (a fund by Klarna co-founder Niklas Adalberth), Future Africa (a fund by Flutterwave co-founder Iyinoluwa Aboyeji) and 500 Fintech T he angel friend consists of Venmo co-founder Iqram Magdon Ismail, some charter members at Plaid, executives at Coinbase, Revolut, Quick, and Paystack

On how the start-up still in stealth handled to get these financiers on board, Pillay states it’s down to the business’s network in the United States and the belief each financier have in the item

” Investing a great deal of time in San Francisco when dealing with Smile has actually assisted us to connect with these worldwide first-rate creators and financiers There’s a chance for us to offer a brand-new generation of monetary services in markets throughout Africa, and we’re truly lucky to have them back us”

For Brent Hoberman, co-founder and executive chairman of firstminute capital, the company chose to back Sew due to the fact that it thinks most online service in Africa will embed fintech abilities in their applications– helping with online payments, increasing financing capability and enhancing KYC and identity checks– through Stitch

” As a fellow South African, I’m delighted to be partnering with a group of remarkably skilled regional engineers with pan-African aspirations,” he included

That stated, Africa’s fintech sector is starting to warm up after a sluggish January which saw agritech and cleantech sectors control moneying rounds Today, South African digital bank TymeBank raised a whopping $109 million to broaden throughout the nation and into Asia, extending the sort of big rounds we have actually seen in the past from a sector that brought in more than 30% of VC financing.

For Stitch, its seed round is the current in a series of noteworthy handle the African API fintech area over the last 2 years, where other significant gamers have actually raised in between $500,000 to $5 million.