After years of losses, African e-commerce giant Jumia declared substantial development towards success in its Q4 2020 Support that declare, Jumia reported record gross revenue and some enhancements to its expense structure.

The business composed in its revenues release that while “2020 has actually been a difficult year operationally with COVID-19 associated supply and logistics disturbance,” it had actually likewise shown “transformative” for its organization design.

Let’s analyze its monetary outcomes to see how Jumia fared throughout the pandemic year and see if we can see the very same course to success gone over in its composed remarks.

The outcomes

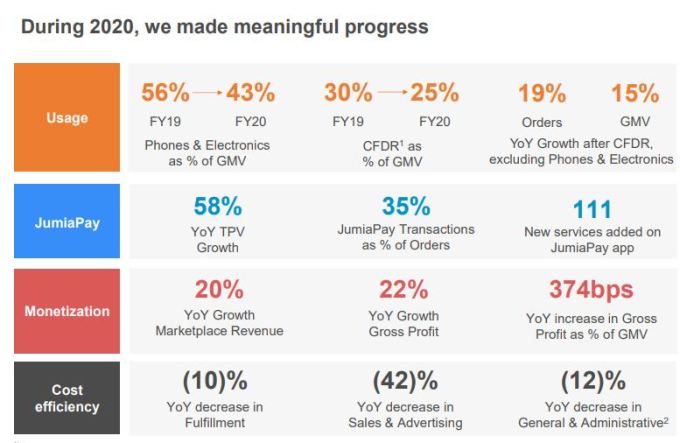

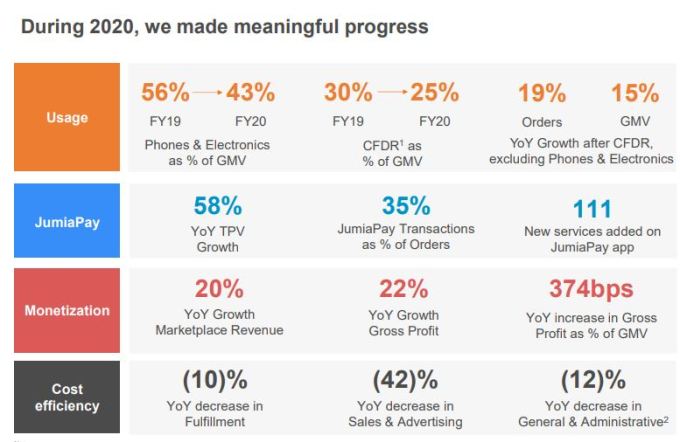

Jumia’s core metrics were irregular in 2020. The business saw its user base grow by 12% in 2020, from 6.1 million consumers in 2019 to 6.8 million consumers That suggests the business included 700,000 consumers in 2020 compared to the 2 million consumers it got the year prior to

Other metrics were unfavorable. The business’s gross product worth (GMV), the overall worth of items offered over a time period, grew 23% from the previous quarter to EUR231.1 million The business stated this was an outcome of the Black Fridays sales in the quarter. Nevertheless, when compared year-over-year, Q4 GMV was down 21% “as the results of business mix rebalancing started late 2019 continued playing out throughout the 4th quarter of 2020,” Jumia composed.

Image Credits: Jumia

In regards to orders made on the platform, Jumia saw a 3% year-over-year drop from 8.3 million in Q4 2019 to 8.1 million in Q4 2020 However while the business’s metrics were blended throughout Q4 and the full-year 2020 duration, there were motivating indications to be discovered.

In 2015, Jumia’s Q4 gross revenue after satisfaction cost was EUR1.0 million. We reported at the time that the number’s positivity was good if simply another mile of the business’s course to success

The business developed on that lead to 2020, enabling it to report a record gross revenue after satisfaction cost outcome of EUR8.4 million in the last quarter of in 2015. From a full-year viewpoint, the numbers are even starker, with Jumia handling simply EUR1.5 million in 2019 gross revenue after satisfaction cost; in 2020, that number grew to EUR23.5 million.

That Jumia handled those enhancements while seeing its 2019 profits of EUR160.4 million slip 12.9% in 2020 to EUR139.6 million is significant.

JumiaPay and enhancement in losses and expenditures

There are other metrics that are motivating for Jumia.

Its gross revenue reached EUR27.9 million in 2020, representing a year-over-year gain of 12% Sales and Marketing cost reduced year-over-year by 34% to EUR10.2 million, while General and Administrative expenses, omitting share-based settlement, pertained to EUR21.8 million in the year, falling 36% year-over-year

In 2019, Jumia sustained a huge EUR227.9 million in losses, a 34% boost from 2018 figures of EUR169.7 million. However that altered in 2015 as Jumia reported a smaller sized EUR149.2 million in operating losses, representing a 34.5% reduction from 2019

Turning from GAAP numbers to more kind metrics, Jumia’s Q4 2020 changed EBITDA loss likewise reduced. The business tape-recorded an adjusted EBITDA of -EUR28.3 million in the last quarter of 2020, falling 47% year-over-year from 2019’s EUR53.4 million Q4 outcome For the complete 2020 duration, Jumia reported EUR119.5 million in adjusted EBITDA losses, down 34.6% from FY19’s -EUR182.7 million outcome.

Jumia lost less cash on an adjusted EBITDA basis in 2020 of any of its full-year durations we have the information for. Still, the business stays deeply unprofitable today and for the foreseeable future.

Fintech

Jumia’s fintech item, JumiaPay, has actually been an element behind its enhancing metrics

In Q1 2020, it processed 2.3 million deals worth EUR35.5 million. That number grew to EUR53.6 million from 2.4 million deals in Q2 2020 In the 3rd quarter of in 2015, it tape-recorded 2.3 million deals with a payment volume of EUR48.0 million. For Q4, JumiaPay carried out 2.7 million deals worth EUR59.3 million.

In overall, JumiaPay processed 9.6 million deals with an overall payment volume (TPV) of EUR196.4 million throughout 2020 TPV increased by 30% in Q4 2020 from its 2019 outcome and 58% in 2020 as a whole.

JumiaPay is a crucial part of Jumia’s organization, as 33.1% of its orders in Q4 2020 were paid for with the service, up from 29.5% in Q4 2019

Share cost and optimism around success

Jumia went public in April 2019. Given that opening as Africa’s very first tech business on the NYSE at $14.50 per share, the business’s stock has actually been on a rollercoaster flight

It traded at $49 per share at one point prior to coping scepticism about its organization design, fraud allegations, and shorting by Andrew Left, a popular short-seller and creator of Citron Research study What followed was the business’s share cost crashing to $26 prior to reaching a lowest level of $2.15 on the 18th of March 2020

Later on, Left made a turnaround after declaring Jumia had actually managed its scams issues. He took long positions at the business and later on proposed it would strike $100 per share. That modification in market belief, combined with the truth that Jumia altered its organization design and stopped operations in Cameroon, Rwanda, and Tanzania, allowed its share cost to climb up back, reaching an all-time high of $69.89 this February 10th

Prior to today’s revenues call, Jumia was trading at $48.81. Given that dropping its most current information, the business’s share cost has actually broadened by around 10% to simply over $54 per share since the time of composing, suggesting financier bullishness in spite of its ongoing operating and changed EBITDA losses